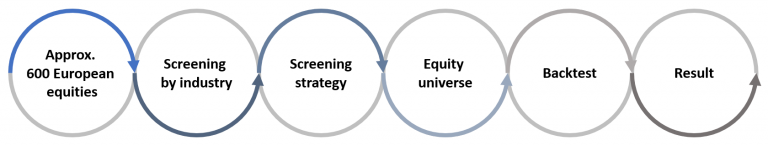

Scientific studies show that established, liquid equity markets are particularly efficient in terms of information. But they also show that there are certain market anomalies that can occur permanently or temporarily. The most well-known anomaly is the value style: In most market phases, fundamentally undervalued value stocks can outperform so-called growth stocks. Our screener supports you in reviewing your personal strategy or it helps you to disenchant your convictions. For example, equities with a high dividend yield are not necessarily among the outperformers.