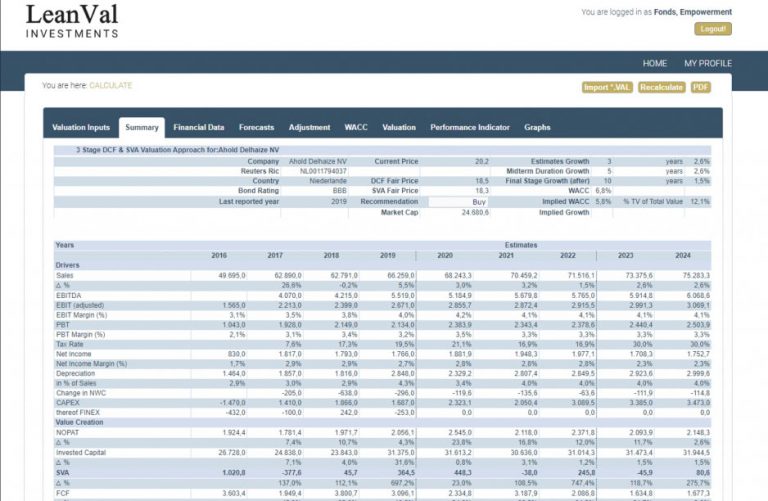

With our accounting and business valuation expertise, we prepare historical financial statements and forecast financial statements for the future. Our goal is to achieve above-average data quality in terms of timeliness, completeness and plausibility. In doing so, we differentiate between the total cost and cost of sales methods, unlike our competitors.

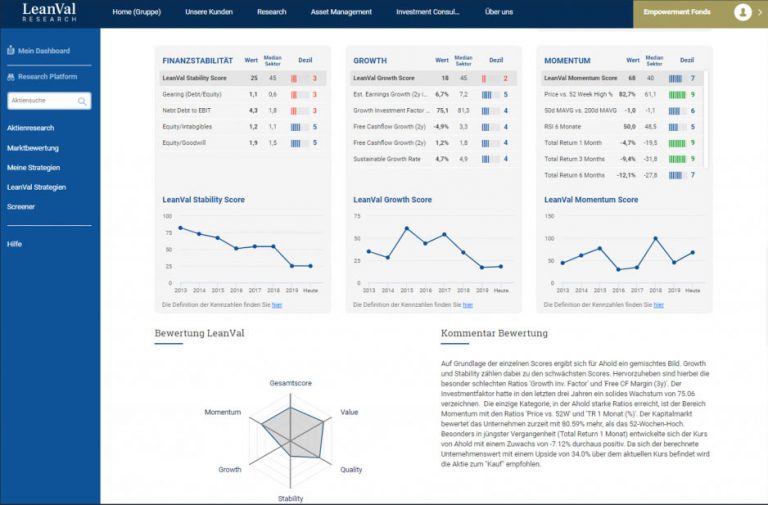

Relative assessment involves valuing a company in relation to its competitors. This involves determining which shares within a sector or the overall market have the highest attractiveness. For the assessment, LeanVal uses a self-designed and academically verified five-factor model.

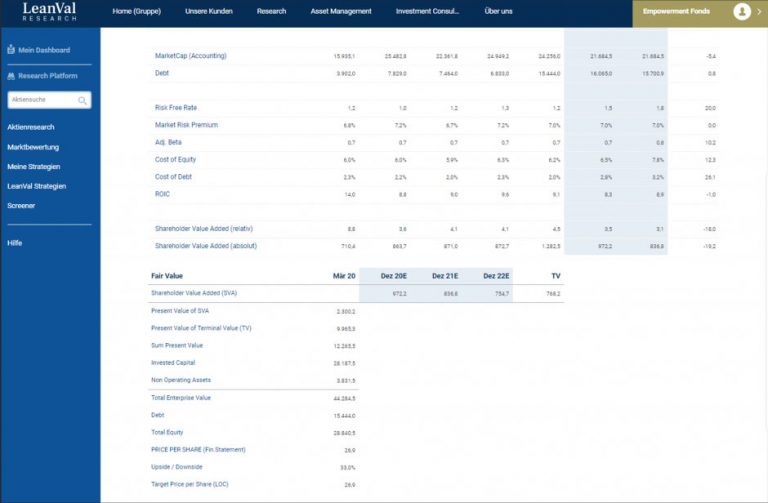

The absolute valuation of a share is determined using the return on invested capital (ROIC) approach. In simplified terms, this involves determining the return on total invested capital over the next few years. This ratio shows whether a company is effectively using the capital it has invested to generate positive value added. Taking into account the capital already invested, the fair value of a company and thus the target price of a share can be determined. This method offers several advantages compared to valuation using discounted cash flow (DCF).

LeanVal also offers its customers the possibility to independently determine the value of a company with the help of the online tool ValueXplorer. Here, the user can make their own assumptions for a variety of parameters, including growth rates, margins, cost of capital, etc. With the help of the tool, different scenarios for the business development of a company can be created and the effects of the different factors can be compared. At the end, the customer receives an individual price target for a share.

+49 69 949488 050

+49 69 949488 050