Discounted cash flow models (DCF) are used in particular to determine the value of a company. The advantages of scenario analysis and the consideration of future business developments can be mentioned in particular. A significant disadvantage, however, is the high dependency of the company value on the so-called terminal value. Even small errors in the assumptions lead to high distortions in pricing.

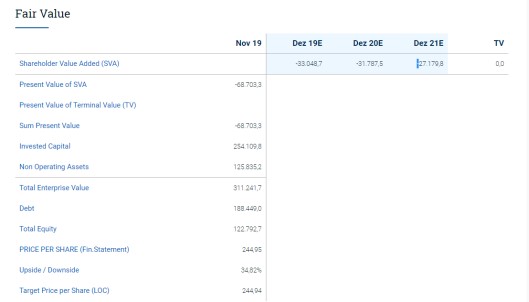

The Return on Invested Capital method (ROIC) uses the advantages of the DCF method, but does not have their weaknesses. By including the already existing invested capital, the focus is shifted to the balance sheet analysis. This allows a much more pronounced risk assessment of the respective business model and promotes an understanding of the underlying value drivers. By including the invested capital, the dependency of the company value on the perpetual annuity is also significantly reduced.

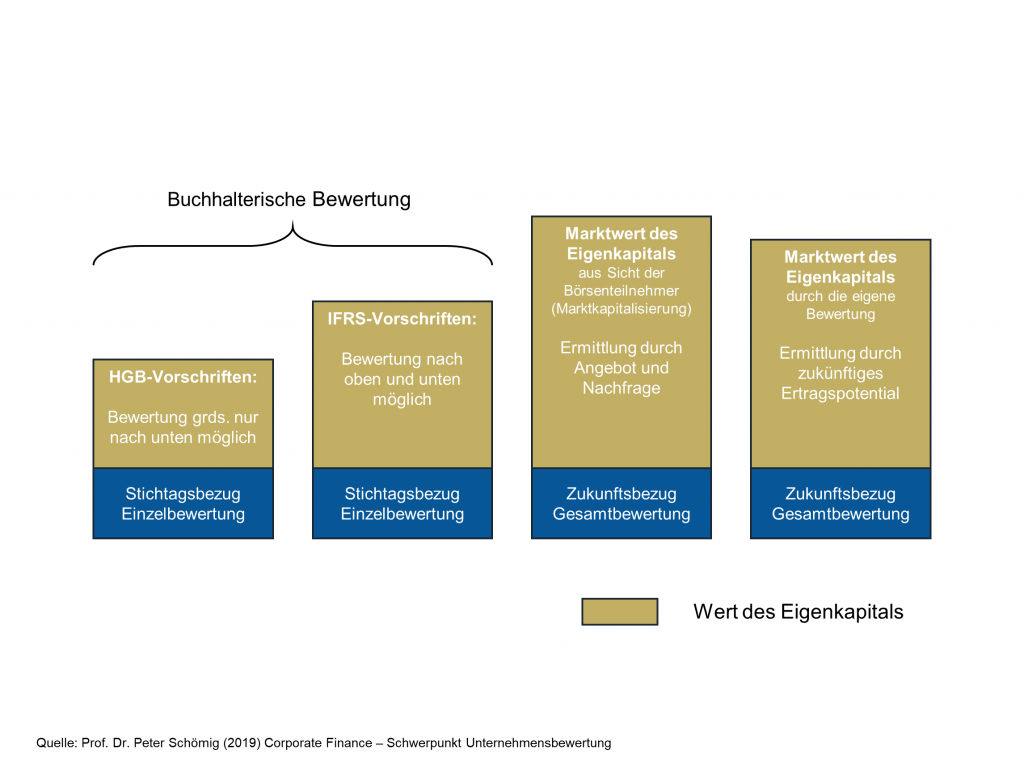

Commercial regulations allow a high degree of accounting policy and design measures. As accounting specialists, we recognize, adjust and evaluate these with regard to the actual quality of the underlying business model. This allows us an undisguised view of the future earnings potential and the determination of the intrinsic value of a company. Based on the differences to the actual value of equity (market capitalization), we create specific instructions (long, long / short, bonds).

ROIC is the abbreviation for Return on Invested Capital. The ROIC (total return on capital employed) is a profit-based profitability indicator that relates the profit before interest on borrowed capital after adjusted taxes (Net Operating Profit after Tax, NOPAT) to the invested capital. In the simplest sense, this metric reflects the company’s ability to effectively use money invested or capital borrowed to generate profits. ROIC can be a useful tool in comparing the relative profitability of one company with another, but it can also be a useful tool for assessing how one company’s profitability has evolved over time. If a company improves its ROIC from 10% in the first year to 12% in the second year, this means that for every 100 euros invested capital, a profit of 10 euros in the first year and 12 euros in the second year was generated. The ROIC can also be an indication that a company has a strong market and competitive position or has a sustainable competitive advantage in its industry. Companies that are very profitable over a longer period of time and achieve a ROIC of over 15% often have a market and competitive advantage

The valuation of financial institutions poses a particular challenge for analysts. Due to the interaction of the inadequate distinction between own and borrowed funds in the cash flow and in the balance sheet, the increasingly complex regulatory requirements for capitalization, special accounting requirements and the existing options, the same valuation models are used as for industry and trade – and service companies not possible. This effect is reinforced by the combination of different business areas and the associated earnings structures in the universal banks primarily listed on the Stoxx Europe 600. The analysts of the LeanVal Group meet this challenge with their own valuation model, based on the dividend discount model in combination with the factor model. In this way, a high-quality statement can be made about the corporate values of the banks / insurance companies, which corresponds to the meaningfulness of the proven ROIC approach for non-financial institutions.

+49 69 949488 050

+49 69 949488 050