Global Economics

With the monthly publication “Dr. Michael Heise on Global Economics” we pick up on current developments that have a significant impact on the economy and capital markets in order to derive trading recommendations for our investors using realistic models.

The quarterly “Quartely Economic Outlook and Financial Markets ” intensifies our market opinion and analyzes detailed facts and developments on the most important asset classes. We also provide an insight into our allocation models there.

Overview

14 days trial access

Get free access to our latest analyst reports for a period of 14 days by completing our free trial.

Free access to our research reports

- Quant Select Fact Sheets

- Stocks in focus

- Stock Market Briefing

- Monthly and Quarterly Reports

Please send me information:

Monthly Reports and Quarterly Economics

| Date | Topic | Details | DE | ENG |

|---|---|---|---|---|

| 21.07.2025 |  | Dr. Michael Heise on Global Economics: Short and long-term prospects for the development of the US dollar After years of strong capital inflows into the US, which boasted a fast-growing economy and a booming technology sector, investors have tended to reduce their positions in US markets in recent months. As a result, the US dollar has lost value, although it is still very highly valued compared to other currencies in terms of purchasing power, as OECD analyses show. Investors were unsure to what extent the customs policy could weaken the economy and whether the policy was deliberately designed to devalue the dollar. | ||

| 05.06.2025 |  | Dr. Michael Heise on Global Economics: Structural growth advantages of the US vs. the EU Donald Trump's tariff increases have increased global uncertainty and caused the US economy and US equities to take a hit. This raises the question of whether the current administration's policies could affect the impressive momentum of the US economy in the medium term. Is the era of US exceptionalism over? | PDF | PDF |

| 30.04.2025 |  | Dr. Michael Heise on Global Economics: Tariffs threaten the German economy With Donald Trump's tariff increases, another pillar of the German economic model is threatening to falter. In addition to systemic competition from China and the cost and tax disadvantages of Germany as a business location, the US market is now also threatening to become a burden. And so the faint hopes that a new government could end the years of economic misery in Germany have already given way to new fears of recession following Donald Trump's tariff shock. | PDF | PDF |

| 26.03.2025 |  | Dr. Michael Heise on Global Economics: Government spending alone is not enough to help the economy The consultation paper of the CDU/CSU and SPD describes an economically challenging situation for Germany. This is a noble description of a development that has been accompanied by economic stagnation and Germany's decline in all location rankings and competitive comparisons for years. Increasing capital outflows, higher insolvencies and rising unemployment are the hallmarks of this. Will the decisions of the potential coalition partners change this and pull Germany out of its economic mediocrity? | PDF | PDF |

| 21.02.2025 |  | Dr. Michael Heise on Global Economics: Elections in Gemany – Economic Policy Must Take Center Stage In the election campaign, migration policy has again become the main topic of debate, while the alarming development of the German economy has taken a back seat. This does not do justice to the relevance of the problem. Without economic growth, Germany will neither be able to maintain its social systems at their current level, accommodate and integrate refugees on a large scale, nor finance the costly digital and green transition of the economy. | PDF | PDF |

| 04.02.2025 |  | Dr. Michael Heise on Global Economics: Outlook 2025 The year 2025 will probably be a crucial year in terms of setting the course for the future. The policies of the new US administration will have a decisive influence on how global trade policy and the global economic order, as well as the security situation, will change. In the EU, the goal is to end Europe's loss of relevance with a growth-oriented policy. In Germany, it is of course also necessary to set the course and create the conditions to end the economic decline of recent years and return to a growth trajectory. | PDF | PDF |

| 10.12.2024 |  | Dr. Michael Heise on Global Economics: Quarterly Economic Outlook and Financial Markets - December 2024 In this issue, Dr. Michael Heise comments on the economy, inflation, monetary and financial policy and capital market developments. He focuses on the European economic area, the USA and the two major Asian economies in China and Japan. Dr. Michael Heise expects a soft landing for the global economy as the most likely scenario. | PDF | PDF |

| 06.11.2024 |  | Dr. Michael Heise on Global Economics: Investment strategies for 2025 - Between economic slowdown and geographical conflicts The year 2025 is also likely to be characterized by political upheaval and global economic changes. At the moment, the prevailing expectation is that a recession can be avoided and that the developed countries can achieve a soft landing with moderate inflation. In this scenario, interest rate cuts are to be expected, which have already been anticipated to a certain extent in recent weeks and months with positive developments at bond and equity markets. | PDF | PDF |

| 13.09.2024 |  | Dr. Michael Heise on Global Economics: Germany's competitiveness Growth and prosperity in Germany have always been heavily dependent on the global economy. International change is a constant companion of the German economy. However, we are currently facing an upheaval that has considerable consequences for the competitiveness and attractiveness of Germany as a business location. | PDF | PDF |

| 15.08.2024 |  | Dr. Michael Heise on Global Economics: Quarterly Economic Outlook and Financial Markets - August 2024 Many factors continue to suggest that the global economy can achieve a soft landing despite the sharp interest rate hikes of the past two years. Subdued inflation rates and significantly rising wages are boosting purchasing power and stabilizing consumption. The combination of moderate growth and inflation that is not quite in line with the target, but still restrained overall, and further interest rate cuts is a fundamentally positive environment for the equity and bond markets. However, there are a number of risks that are difficult to calculate and are likely to generate high volatility. | PDF | - |

| 30.07.2024 |  | Dr. Michael Heise on Global Economics: What will drive the capital markets in 2024/25 Investors who want to get an idea of capital market trends and successful investment strategies in developed countries are currently dealing with a variety of influencing factors that could determine economic growth and inflation in the coming quarters. Views on the US election and the political consequences are just as important as considerations on the growth and earnings potential of artificial intelligence. It is also important to see whether politicians in Europe will do anything to counter the persistently weak economic growth. And the geopolitical trouble spots in the Middle East and Ukraine will also continue to have an impact on overall economic development. | PDF | PDF |

| 06.06.2024 |  | Dr. Michael Heise on Global Economics: US election - Trump or Biden and the economic consequences The US economy has been in robust condition since the Covid crisis was overcome. The picture is characterized by significant employment gains, recent positive productivity trends and rising investment. The significant rise in interest rates since spring 2022 has not had a major impact on the economy and the economic consequences of the Russian attack on Ukraine have remained limited. | PDF | PDF |

| 15.05.2024 |  | Dr. Michael Heise on Global Economics: How good will the capital market year 2024 be? With the generation capital, a third pillar is being introduced into the financing of the statutory pension insurance. In addition to contribution income and a federal subsidy, income from the capital market investments of a public foundation will also contribute to financing pension expenditure in the future. | PDF | PDF |

| 23.04.2024 |  | Dr. Michael Heise on Global Economics: Quarterly Economic Outlook Special - April 2024 Germany has hardly been able to achieve any economic growth for years. As at the beginning of this century, we are once again regarded as the sick man of Europe. An economic policy that focuses on better economic conditions and competitiveness is required in order to emerge from the weak growth and to bring Germany's competitive potential back to the fore. Without a growth and investment-oriented economic policy, it will hardly be possible to put an end to the talk of Europe's sick man. | PDF | - |

| 26.03.2024 |  | Dr. Michael Heise on Global Economics: How good will the capital market year 2024 be? The capital markets started 2024 with a high level of confidence. Although hopes of substantial interest rate cuts by central banks had to be dampened somewhat and capital market yields have risen since the start of the year, the stock markets have made strong gains. But can this trend continue? | PDF | PDF |

| 07.03.2024 |  | Dr. Michael Heise on Global Economics: The German government's pension package - After the reform is before the reform After months of work, the German government has presented its "pension package II". There were no major surprises. It essentially consists of two elements that were already agreed in the 2021 coalition agreement. It is therefore also clear that, despite the innovations, contribution rates are expected to rise due to the relative increase in the pension level after 2025. | PDF | PDF |

| 10.01.2024 |  | Dr. Michael Heise on Global Economics: Global economy and capital markets - trends in 2024 Economic growth is expected to be rather weak in 2024, but the economy is not expected to shrink. The burden on borrowers from higher interest rates will be offset by positive effects from rising wages and incomes in real terms. Inflation will be significantly lower than in 2023, but will not reach the central banks' average target for 2024. Interest rate cuts by central banks will be smaller than the current optimistic expectations of the financial markets. | PDF | PDF |

| 14.12.2023 |  | Dr. Michael Heise on Global Economics: Quarterly Economic Outlook and Financial Markets - December 2023 At the end of 2023, Dr. Michael Heise analyzes the state of the global economy and identifies clear differences between the three most important economies: the USA, China and Europe. Due to the rise in interest rates, the global economy should remain in troubled waters in 2024. Dr. Heise also warns against too much optimism with regard to interest rate cuts and explains what this means for the equity and bond markets. | PDF | - |

| 08.11.2023 |  | Dr. Michael Heise on Global Economics: Capital markets influenced by interest rate trends In the current issue, Dr. Michael Heise analyzes the development of central bank interest rates and their potential impact on capital market returns in 2024. | PDF | PDF |

| 13.09.2023 |  | Dr. Michael Heise on Global Economics: Germany needs more equity savers In the current issue, Dr. Michael Heise analyzes participation in the capital market in Germany and compares it with other countries. In addition, he shows ways to strengthen participation in the capital market. | PDF | PDF |

| 15.08.2023 |  | Dr. Michael Heise on Global Economics: Quarterly Economic Outlook and Financial Markets - August 2023 In the current issue, Dr. Michael Heise discusses the economic situation in the U.S., China and the euro area. In addition, he provides an outlook on the further growth prospects and analyzes what impact inflation and monetary policy should have on the bond and stock markets. | PDF Nur im 14-tägigen Testzugang verfügbar. | - |

| 24.07.2023 |  | Dr. Michael Heise on Global Economics: The probability of a recession in the US is falling iven the weakness of the European economy and a faltering recovery in China, stimulus from the US economy would be highly desirable. However, the economic development of the USA will also be decisive in determining whether the Democrats have a good chance of re-election and whether the capital markets will continue to be optimistic about the time ahead, as they were in the 1st half of 2023. At the same time, the forecast is more complex than ever due to numerous shocks in recent years. For example, the widely predicted economic slump has so far failed to materialize. | PDF Nur im 14-tägigen Testzugang verfügbar. | PDF Nur im 14-tägigen Testzugang verfügbar. |

| 15.05.2023 |  | Dr. Michael Heise on Global Economics: The ECB's strategy regarding inflation No one could have predicted the inflation effects of covid pandemic and the Ukraine war with any accuracy. But the European central bank's misjudgments were particularly pronounced and consequential. The fight against unexpectedly high inflation will weaken growth and burden households and firms. These costs cannot be avoided. However, they can be limited if the central bank pursues a clear and reliable stabilization course. | PDF Nur im 14-tägigen Testzugang verfügbar. | PDF Nur im 14-tägigen Testzugang verfügbar. |

| 02.05.2023 |  | Dr. Michael Heise on Global Economics: Quarterly Economic Outlook and Financial Markets - April 2023 At the end of the first quarter of 2023, Dr. Michael Heise analyzes the stability of the financial markets following the problems of American regional banks and the emergency takeover of Credit Suisse. He also examines the state of the global economy and provides an outlook for growth prospects in the developed economies. | PDF Nur im 14-tägigen Testzugang verfügbar. | - |

| 29.03.2023 |  | Dr. Michael Heise on Global Economics: A new banking crisis? Will the financial stress triggered by the collapse of Silicon Valley Bank remain temporary and limited - or will the situation come to a head and become a systemic crisis? Even days after the collapse of Silicon Valley Bank (SVB) in the U.S., there is no consensus among financial market experts as to whether the turbulence it has triggered on the global financial markets will soon end or whether it could grow into a systemic crisis. | PDF Nur im 14-tägigen Testzugang verfügbar. | PDF Nur im 14-tägigen Testzugang verfügbar. |

| 02.03.2023 |  | Dr. Michael Heise on Global Economics: Economy in upheaval - 5 conclusions for German medium-sized companies What does the reality of the recent crisis mean for German medium-sized companies? What conclusions should companies draw from the current developments surrounding Covid, the Ukraine war and inflation? Inflation, energy problems, rising interest rates: the past year has demanded a lot from consumers. Which problems will remain with us, where are solutions emerging. | PDF Nur im 14-tägigen Testzugang verfügbar. | PDF Nur im 14-tägigen Testzugang verfügbar. |

| 09.01.2023 |  | Dr. Michael Heise on Global Economics: Five theories for 2023 High inflation, energy problems, rising interest rates: the past year has demanded a lot from consumers. Which problems will remain, and where are solutions emerging? Five theories for the year 2023 | PDF Nur im 14-tägigen Testzugang verfügbar. | PDF Nur im 14-tägigen Testzugang verfügbar. |

| 22.12.2022 |  | Dr. Michael Heise on Global Economics: Quarterly Economic Outlook and Financial Markets, December 2022 In this publication, Dr. Michael Heise analyzes the economic situation based on current data and provides an outlook on trends for 2023. In this context, he also looks back on the trends in 2022, which was characterized by new challenges and uncertainties. | PDF Nur im 14-tägigen Testzugang verfügbar. | - |

| 24.11.2022 |  | Dr. Michael Heise on Global Economics: The need for a new position agenda The German economy has run into rough waters: The Ukraine war and energy crisis have exacerbated existing problems - and prompted policymakers to focus primarily on current issues. However, inactivity in location policy is just as risky. | PDF Nur im 14-tägigen Testzugang verfügbar. | PDF Nur im 14-tägigen Testzugang verfügbar. |

| 23.09.2022 |  | Dr. Michael Heise on Global Economics: Were the Russia sanctions a mistake? At first glance, the results of the Russia sanctions are sobering. There is no sign of even a rudimentary relenting in the war against Ukraine. he energy price shock, on the other hand, has had a severe impact on the economies of Europe. Were the sanctions a mistake? | PDF Nur im 14-tägigen Testzugang verfügbar. | PDF Nur im 14-tägigen Testzugang verfügbar. |

| 14.07.2022 |  | Dr. Michael Heise on Global Economics: New approach for the business location Germany Germany is on the verge of recession. Consumers' purchasing power is suffering from the surge in inflation triggered by the rise in energy and food prices, which has now spread to many other groups of goods. As long as the Ukraine war and the sanc-tions against Russia continue, and unfortunately there is no end in sight, the energy markets will remain tense. | PDF Nur im 14-tägigen Testzugang verfügbar. | PDF Nur im 14-tägigen Testzugang verfügbar. |

| 14.06.2022 |  | Dr. Michael Heise on Global Economics: Ukraine War and Covid The Ukraine war is a humanitarian low point and a geopolitical watershed that will result in fundamental changes in the world order. New patterns of division of labor will emerge for the economy. Political risks have increased for companies and investors. | PDF Nur im 14-tägigen Testzugang verfügbar. | PDF Nur im 14-tägigen Testzugang verfügbar. |

| 06.04.2022 |  | Dr. Michael Heise on Global Economics: Turning point of the Inflation An almost global increase in consumer prices will make 2022 very unpleasant for consumers in many countries. Here in Germany and in the EMU, consumer prices are already more than 7% higher than in the previous year and threaten to rise further | PDF Nur im 14-tägigen Testzugang verfügbar. | PDF Nur im 14-tägigen Testzugang verfügbar. |

| 28.02.2022 |  | Dr. Michael Heise on Global Economics: Ukraine Crisis The Russian attack on Ukraine will have far-reaching global political and economic implications. It has already fundamentally changed the security architecture in Europe. Further developments will depend on the outcome of the current crisis. | PDF Nur im 14-tägigen Testzugang verfügbar. | PDF Nur im 14-tägigen Testzugang verfügbar. |

| 26.01.2022 |  | Dr. Michael Heise on Global Economics: Monetary Policy and Interest Rates - 2022 With the long underestimated and virtually global rise in inflation in recent months, central banks have come under pressure to exit their expansionary monetary policies soon. For investors, the question arises as to how consistently the central banks will take action, what this means for the economy and whether significant setbacks on the capital markets are to be expected? | PDF Nur im 14-tägigen Testzugang verfügbar. | PDF Nur im 14-tägigen Testzugang verfügbar. |

| 15.01.2022 |  | Dr. Michael Heise on Global Economics: The Economy Matters! The new coalition government started out with the goal of modernizing Germany and daring to make more progress. Dr. Michael Heise explains why the right economic policy plays a very important role in achieving these ambitious goals. | PDF Nur im 14-tägigen Testzugang verfügbar. | PDF Nur im 14-tägigen Testzugang verfügbar. |

| 06.12.2021 |  | Dr. Michael Heise on Global Economics: China - Buying Opportunity or Time to Pull the Ripcord? China's stock market has been lagging the global market for some time, and the riskier bond markets have also given investors little pleasure of late. Investors are asking themselves whether the time has come again for an entry - or whether they would be better off giving the country a wide berth for the long term. | PDF Nur im 14-tägigen Testzugang verfügbar. | PDF Nur im 14-tägigen Testzugang verfügbar. |

Quarterly Economic Outlook and Financial Markets

| Date | Topic | Details | Link |

|---|---|---|---|

| 05.05.2022 |  | Dr. Michael Heise on Global Economics: Quarterly Economic Outlook and Financial Markets, Mai 2022 Global economy shifts down a gear: The recovery of the global economy, which characterized 2021, stalled at the beginning of the year. In addition to corona restrictions still in place in many places, high price level increases due to rising energy and raw material prices weakened private consumption. |

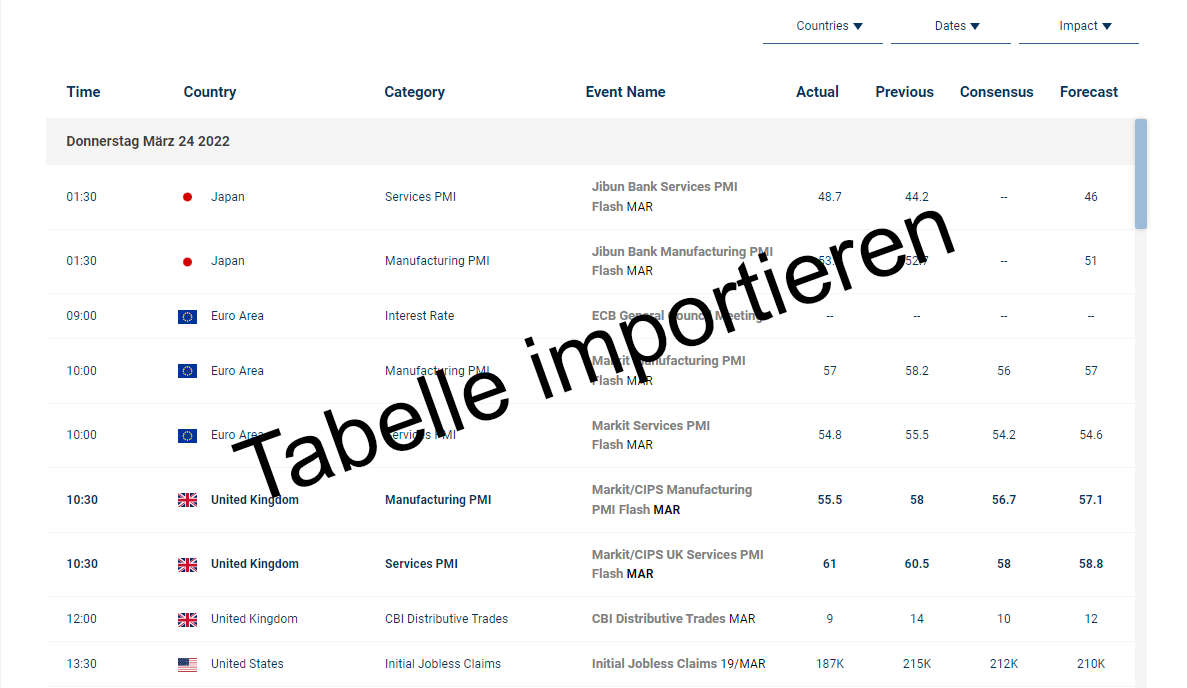

Business calendar