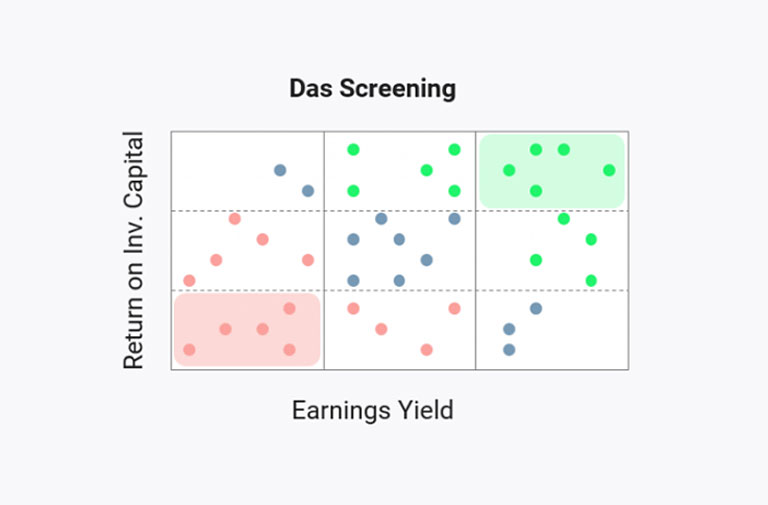

In addition to company analysis and valuation, the LeanVal Research Navigator also offers the possibility of designing equity strategies and the associated portfolio creation. With the help of the LeanVal Screener, a wide variety of strategies can be created and tested with regard to their historical performance.

LeanVal offers its users a variety of ready-made sample strategies. The presentation of the historical development allows our customers to make statements about their advantageousness in different market phases and offer the current portfolios corresponding to the strategy. With each of the presented strategies there is the possibility to include an ESG selection.

Our team pursues functional and academically verified multifactor approaches. The main strategy developed by LeanVal is a five factor model (Value, Quality, Stability, Growth and Momentum) which has proven to be very high-performance and robust in various market phases. The factors were designed in-house and are fundamental as well as market-technical factors. In the other LeanVal strategies, the five factors were weighted differently depending on the investment motive.

These are strategies pursued by particularly successful asset managers, which have been academically elaborated and widely discussed in the financial literature. The respective approaches are duplicated here.

These strategies focus on one of the five factors (value, quality, stability, growth and momentum).

Our team pursues functional and academically verified multifactor approaches. The main strategy developed by LeanVal is a five-factor model.

These are strategies pursued by particularly successful asset managers, which have been academically elaborated and widely discussed in the financial literature. The respective approaches are duplicated here.

These strategies focus on one of the five factors (value, quality, stability, growth and momentum).

+49 69 949488 050

+49 69 949488 050