Our team pursues functional and academically verified multifactor approaches. The main strategy developed by LeanVal is a five factor model (Value, Quality, Stability, Growth and Momentum) which has proven to be very high-performance and robust in various market phases. The factors were designed in-house and are fundamental as well as market-technical factors. In the other LeanVal strategies, the five factors were weighted differently depending on the investment motive.

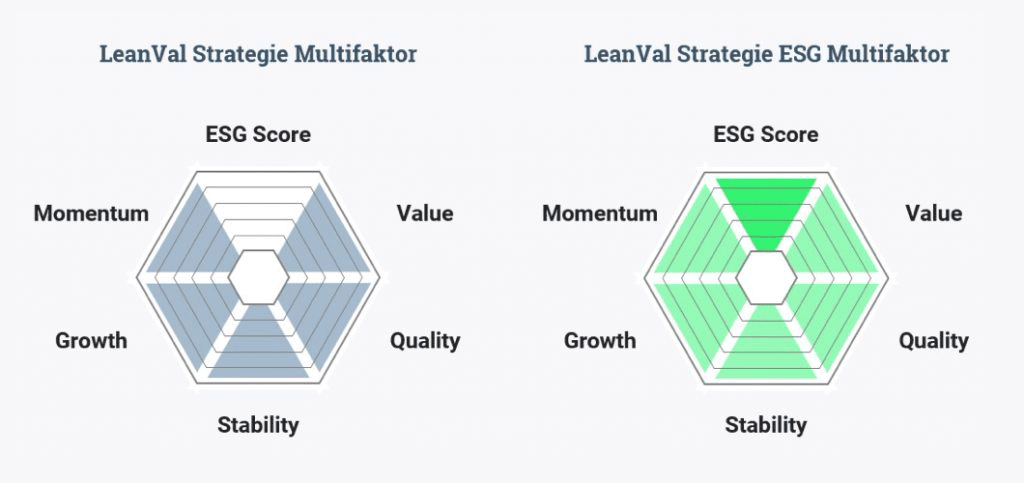

In the LeanVal multifactor strategy, the five factors value, quality, stability, growth and momentum are used equally weighted for stock selection. By including all factors, a well-founded and comprehensive assessment of each share is taken into account. This makes the result robust against outliers, since when viewed over a longer period of time, focusing on one factor alone can hardly outperform the market. With the help of the multifactor strategy, balanced and attractive portfolios can be created.

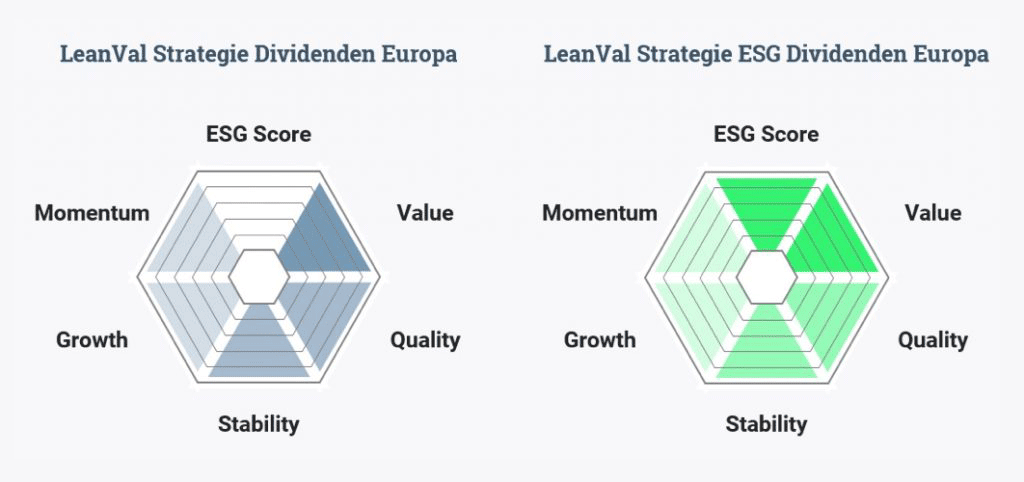

The Sustainable Dividend strategy focuses on stocks with the highest dividend yield. When determining the shares, both the current and the expected dividend yield are used. In addition, it is taken into account whether a company is able to generate high free cash flows and whether this will also be the case in the future. This is an important indicator of the potential for further dividend increases. In addition to the above-mentioned key figures from the value area, the other factors also flow into the strategy as a small addition.

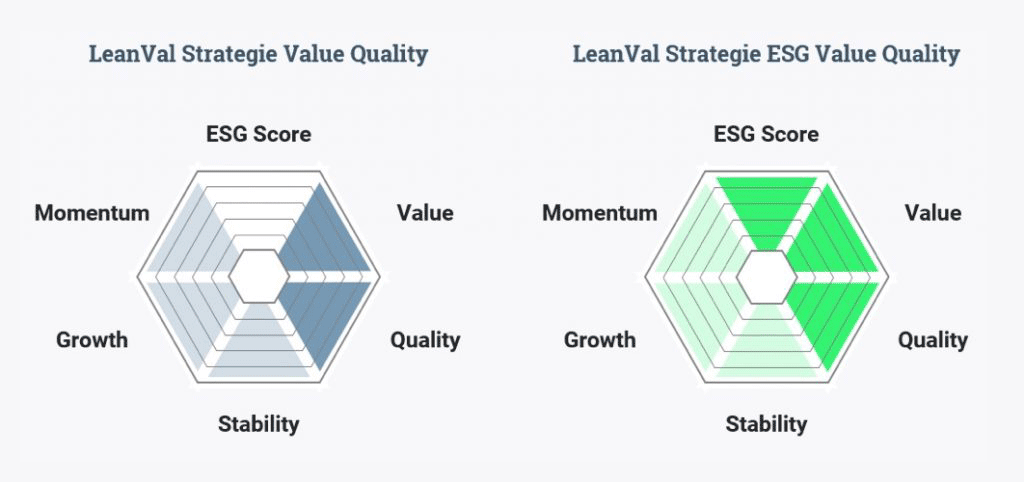

The LeanVal Quality Value strategy relies on stocks that can achieve high scores in the areas of value and quality. These companies are characterized by strong fundamental data such as a healthy balance sheet structure, a stable and established business model with robust earnings, high added value, attractive cash flows and a comparatively low valuation on the stock market. Both key figures derived from past values and from forecasts are taken into account. In addition to value and quality, the strategy also includes, to a small extent, the other factors of the LeanVal universe.

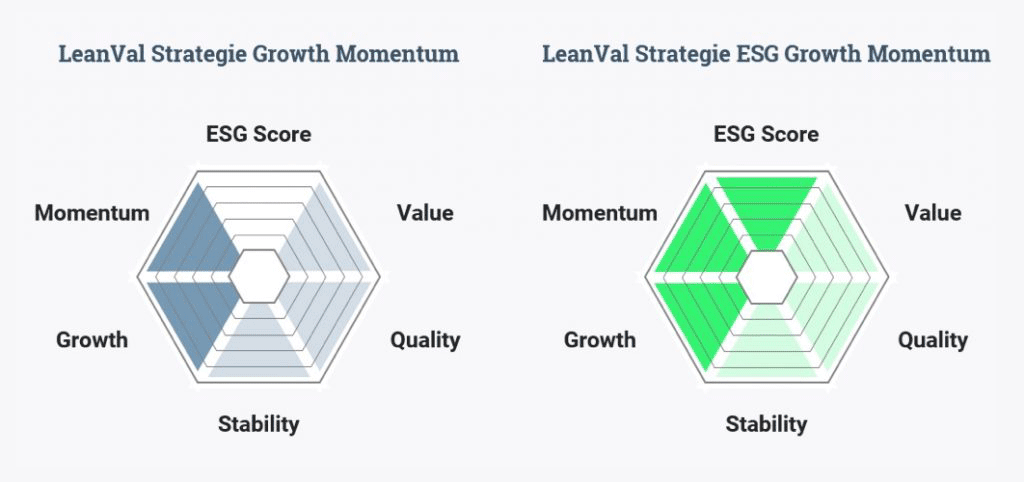

The growth momentum strategy focuses on companies that can achieve high growth rates and thus offer great potential for successful future business development. In this context, important criteria include profit growth, free cash flow growth, the amount of investment and the sustainability of the growth achieved. The second component of the strategy is a stock’s momentum. According to the stock market adage “The trend is your friend”, stocks are identified that show an attractive price development. Among other things, the performance of the last few months, moving averages (200-day line, etc.) and the relative strength index are used here. As an addition, the other LeanVal factors are included in the selection of the stocks with a small weight.

In addition to the LeanVal and Guru strategies, the research platform also offers the possibility to create individual stock strategies. Each key figure can be selected individually from the five LeanVal factors Value, Quality, Stability, Growth and Momentum, which in turn are made up of a large number of sub-factors, as well as from the range in the Multifactor area. This results in a range of more than 50 key figures that can be selected individually. In a second step, each factor can be assigned its own weight.

In this way, tailor-made strategies can be developed that can be individually adapted to the requirement profile of each investor. The subsequent backtest provides detailed information about the performance the selected strategy would have achieved in the past years. By trying out different variations and investment styles, a variety of different investment ideas can be generated in this way.

+49 69 949488 050

+49 69 949488 050