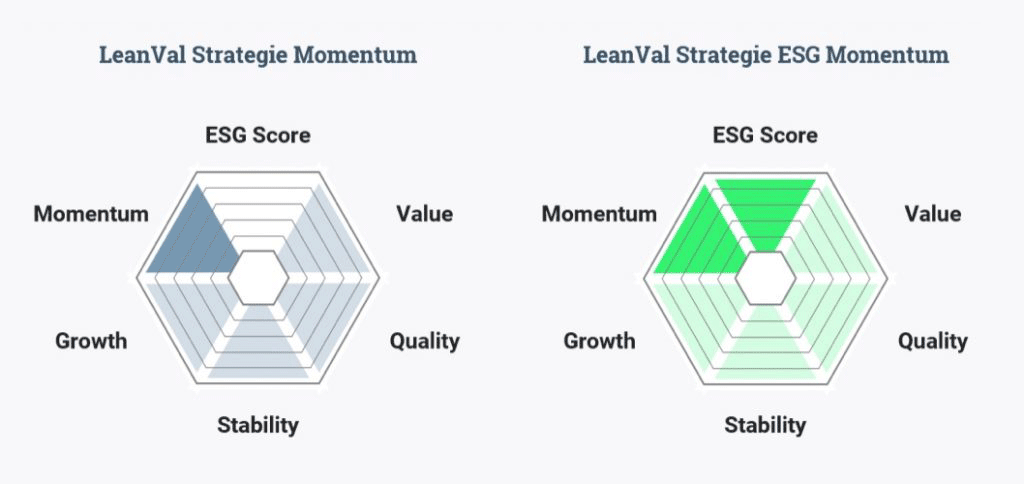

These strategies focus on one of the five factors (value, quality, stability, growth and momentum).

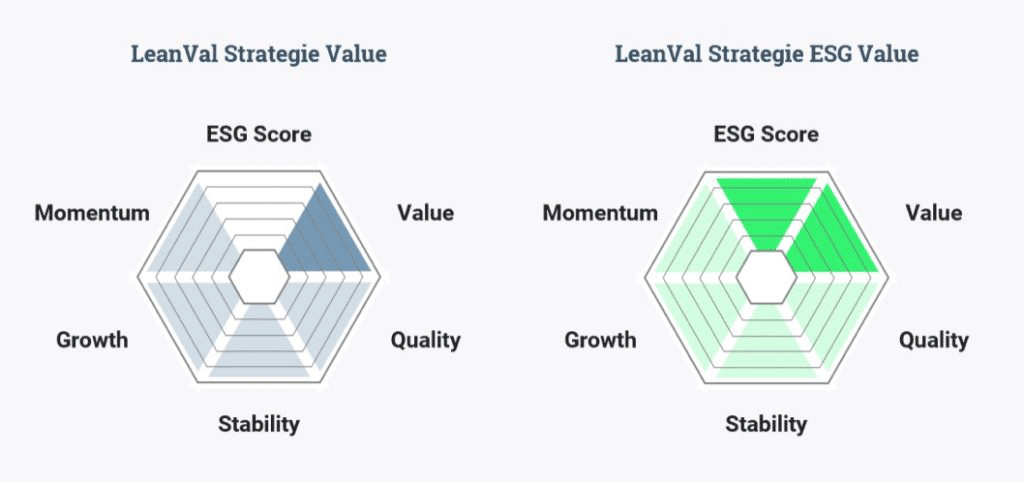

When selecting stocks, the smart value strategy primarily takes into account key figures from the value area and is therefore particularly aimed at pure value investors. The strategy compares the real economic value of a company’s investments (intrinsic value) with the current market value. Important key figures here include the price / book value ratio, the price / earnings ratio and the price / free cash flow ratio. Other key figures measure the ratio of enterprise value (market capitalization plus debt, minus total cash and cash equivalents) to EBIT, EBITDA or free cash flow. In addition to the value factors, the upside potential of a share is also included with a small proportion on the basis of the price targets determined.

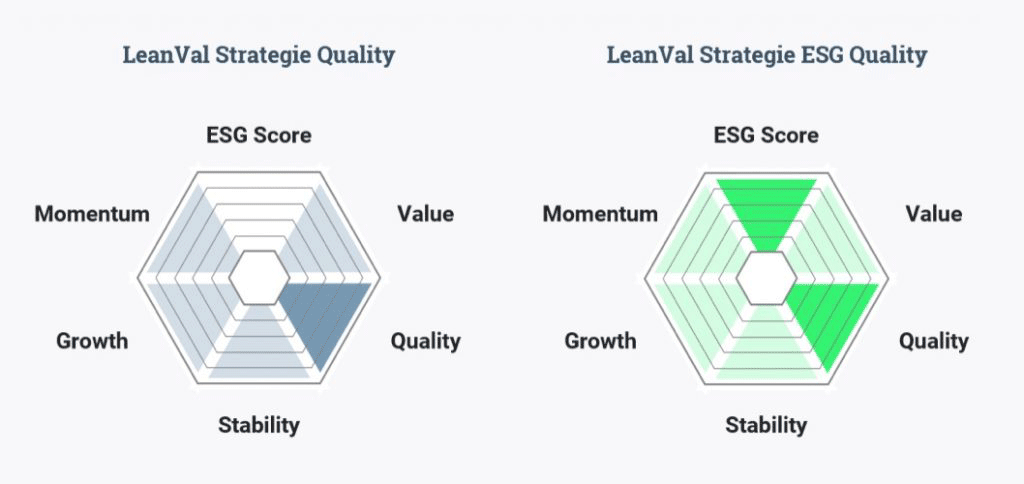

The focus of the Smart Quality Strategy is on filtering out quality companies. These must have consistently achieved good performance indicators in the past. Of course, this is not a clear indicator for the future. However, such companies prove that they can achieve growth even in phases of weaker economic development and are thus armed for the challenges of the future. The key figures of these strategies include growth and the continuity of growth in terms of operating cash flow, EBIT and return on invested capital (ROIC). With a small factor, the price potential is also part of the smart quality strategy.

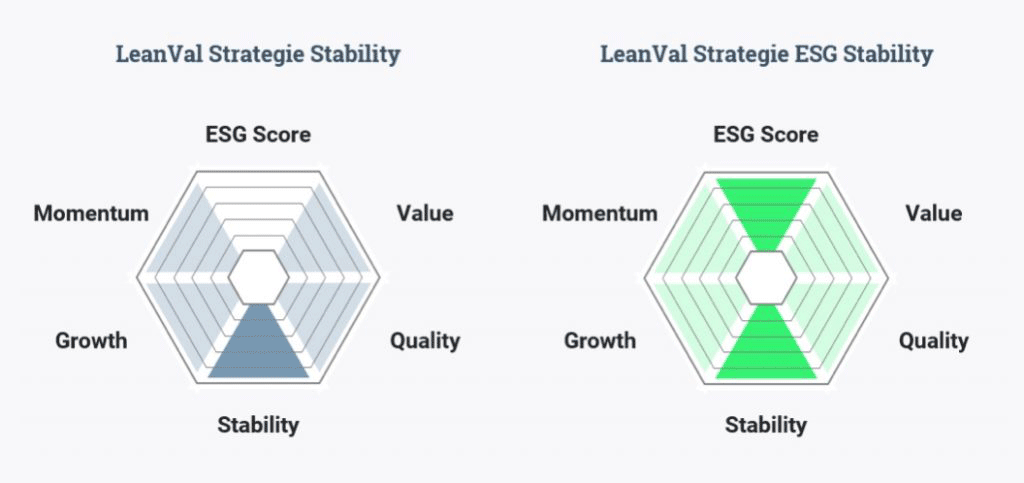

The Smart Stability Strategy attaches particular importance to the stability of a company and the intrinsic value of the balance sheet. The selected stocks have an above-average financing structure and are in possession of valuable assets. Such companies therefore have a good substance that offers some protection even in an economic downturn. Important key figures when selecting stocks for this strategy are, for example, the ratio of net financial debt to EBIT or gearing (ratio of debt to equity). The ratio of equity to goodwill and of equity to intangible assets are also important. In addition to the stability factor, the price potential is also taken into account as an admixture.

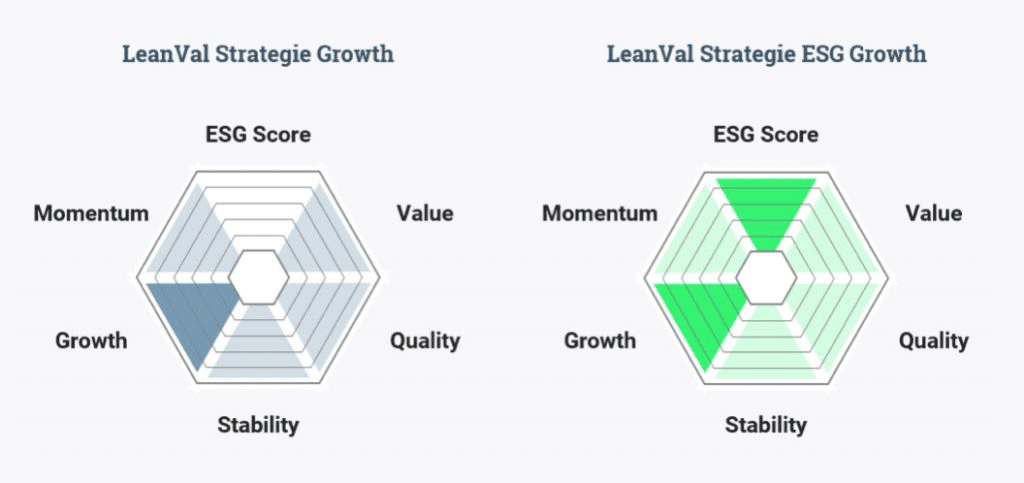

The growth strategy relies on stocks that can achieve above-average growth rates or have a strong position in future growth markets. Promising future prospects can thus arise for these companies. Proponents of this strategy assume that future growth is underestimated by the market and is therefore not yet reflected in the share price. The following key figures are used to assess growth: expected profit growth and its sustainability, expected growth in free cash flow and the free cash flow margin as well as the ratio of investments to depreciation. In addition to the growth factor, the price potential also flows into the consideration to a small extent.

Momentum informs an investor of the pace and strength of a stock’s upward movement. This strategy thus picks up key figures from the area of chart analysis. The strategy is therefore suitable for investors who expect a continuation of a positive trend that has already started. It could also be of interest to investors whose investment horizon is more short-term. The key figures in the area of momentum include the price development in the recent past (1 month, 3 months, 6 months and 12 months), the distance between the current price and the 52-week high and the relative strength index (6 months). Another key figure takes into account the ratio of the share price on a 50-day average to the 200-day average.

+49 69 949488 050

+49 69 949488 050