LeanVal Research Platform

Share valuation, share selection, share strategies. Use our platform in the current turbulent stock market phase.

US election - Trump or Biden and the economic consequences

With the monthly publication “Dr. Michael Heise on Global Economics”, we address current developments that have a significant impact on the economy and the capital markets.

In this issue, Michael Heise looks ahead to the US election in November and analyzes which impact a Trump or Biden victory would have on the economy and what implications this would have for investors.

Shares in focus "Multifactor"

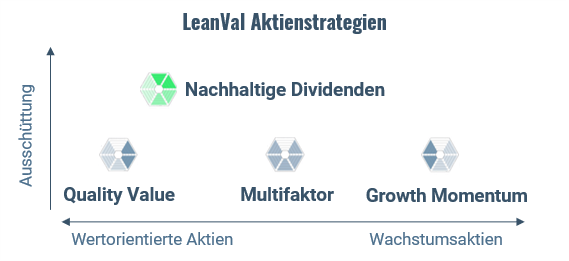

The LeanVal multi-factor strategy uses the five factors of value, quality, stability, growth and momentum with equal weighting for stock selection. This makes the result robust against outliers, as the focus on one factor alone can hardly outperform the market over a longer period of time.

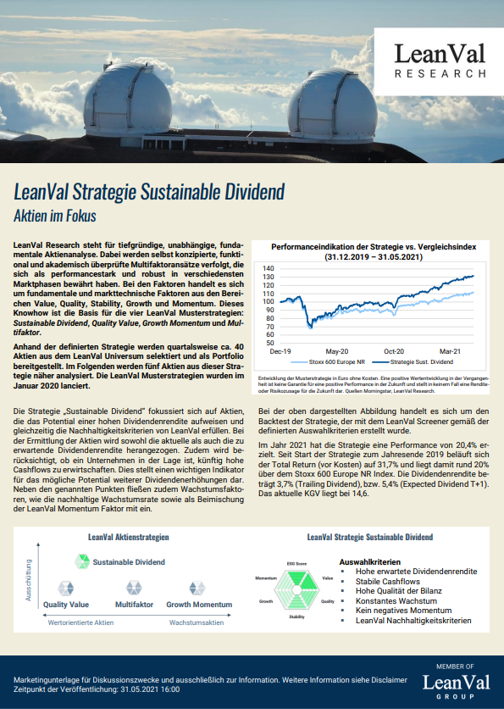

Shares in focus "Sustainable Dividend"

The “Sustainable Dividend” strategy focuses on equities with the highest dividend yields. This also takes into account whether a company is in a position to generate high free cash flows and whether this will also be the case in the future. This is an important indicator of the potential for further dividend increases.

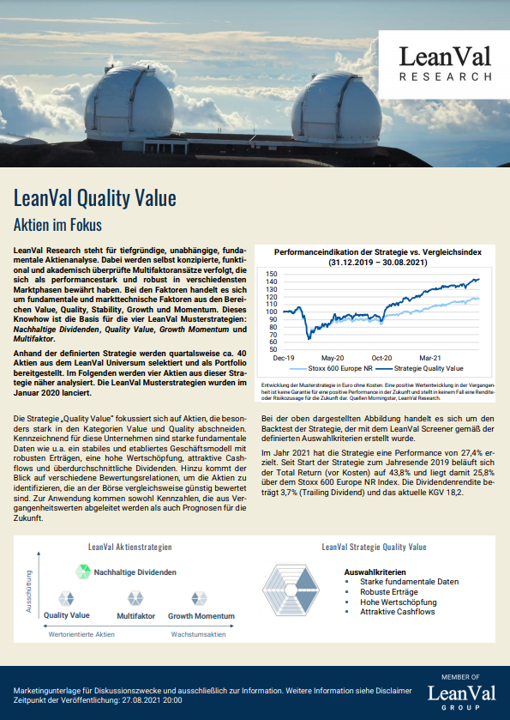

Shares in focus "Quality Value"

This strategy focuses on stocks that perform particularly well in the value and quality categories. These companies are characterized by strong fundamentals, a stable and established business model and a comparatively low valuation on the stock market.

Valuation of Banks - The Income Approach

The Academic Paper “Valuation of Banks – The Income Approach” by LeanVal Research deals with the special features of accounting for banks and presents some models for the valuation of financial institutions.

As specialists in accounting and company valuation, we place a special focus on the risk evaluation of the business areas, the determination of value drivers and the competition analysis. The stringent analysis and valuation approach, based on the ROIC valuation (“Return on Invested Capital”), is supported by our proprietary software with elements of artificial intelligence.

Thanks to our extensive industry and branch know-how, we have a high level of competence in the analysis of individual companies or entire portfolios. At the customer’s request, certain companies or industries can be evaluated exclusively. The customers of our buy-side research are family offices, asset management companies, asset managers and foundations. In addition, we advise companies outside the financial sector on corporate valuation issues.

LeanVal Research Platform

The research platform offers fundamental equity analysis with relative assessment and absolute valuation for approx. 600 European and approx. 500 US equities. Our goal is an above-average high quality of the data, both for historical and forecast annual financial statements. With the data, selection strategies for stocks can be designed quickly and easily and historically tested. In addition, LeanVal creates its own equity strategies.

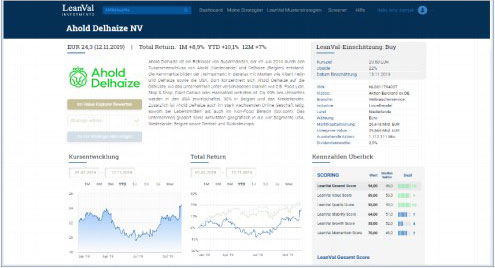

Stock analysis

In addition to an overview of the most important stock indices, the equity analyses include the equity snapshot with the ValueXplorer, the equity filter and research reports on individual stocks.

Equity strategies

Here you will find our active equity strategies and a range of themed stocks. You can create your stock lists or use the screener to create and test your own strategies.

Market analyses

The ROIC approach uses a bottom-up process to draw conclusions about the attractiveness of individual countries and industries. Here they also receive analyses on specific megatrends.

Global Economics

With the publication series “Dr. Michael Heise on Global Economics” we address current developments that have a significant impact on the economy and capital markets.

Our philosophy

Profit is not always success

A one-sided look at the profits of a company does not allow any conclusions to be drawn about the performance of a company.

Advantages of the ROIC process

Our proprietary evaluation and analysis approach based on the ROIC allows the added value and thus the real success of a company to be determined.

LeanVal Equity Strategies

Factor-based investing has gained prominence in institutional investor portfolios. LeanVal provides figures for smart beta investors.

The pricing models

Try now for 14 days free of charge.

After the test phase, the minimum term is 12 months and is then extended by three months. The notice period is one month.

Private

Investors

BASIC

Entry-level versionin our research platform

- ONE LICENSE

- LeanVal Economics

- Assessment of equity markets

- Equity research

EU equities

Absolute valuation

Relative assessment

Research publications

- Equity strategies

LeanVal Multifactor

LeanVal Sustainable Dividend

Leanval Quality Value

Leanval Growth Momentum - Own watchlists

US equities: € 49 per month (incl. VAT)

Equity screener: € 49 per month (including VAT)

Institutional

Investors

GOLD

Full functionality of the platformwith Equity Screener and Value Explorer

- TWO LICENSES

- LeanVal Economics

- Assessment of equity markets

- Equity research

EU & US equities

Absolute valuation

Relative assessment

Research publications

ValueXplorer - Equity strategies

LeanVal Multifactor

LeanVal Sustainable Dividend

Leanval Quality Value

Leanval Growth Momentum - Own watchlists

- Equity screener & backtest

€ 500 per month (plus VAT)

Individual consulting and company analysis for listed and unlisted companies € 250 per hour (plus VAT).

Institutional

Investors

PLATINUM

All functions of the research platformand personal support

- TWO LICENSES

- LeanVal Economics

- Assessment of equity markets

- Equity research

EU & US equities

Absolute valuation

Relative assessment

Research publications

ValueXplorer - Equity strategies

LeanVal Multifactor

LeanVal Sustainable Dividend

Leanval Quality Value

Leanval Growth Momentum - Own watchlists

- Equity screener & backtest

- Access to analysts

5 hours per month

€ 2,750 per month (plus VAT)

Access to analysts

10 hours per month

Individual consulting and company analysis for listed and unlisted companies € 250 per hour (plus VAT).

The range of services is based on your work profile

Equity Analyst

The main focus of your tasks is on business valuation. You are interested in the detailed figures or would like to evaluate companies with your own assumptions. Our platform offers you the following services:

1. Valuation with the LeanVal approach: We use the high data quality to calculate price targets with an adjusted ROIC method.

2. Valuation with the LeanVal Value Explorer: For your individual company valuation with your forecasts and growth scenarios, a three-stage ROIC valuation model is available.

Investment Manager / Smart Beta Investor

In your company you are responsible for the selection of equities or the design of investment processes. You have an idea of your investment philosophy and are looking for a platform to implement your ideas quickly and easily. Your tools at LeanVal:

1. Equity screener

- LeanVal Smart Beta Strategies

- Selected Guru Strategies

- Configuration of individual selection strategies

2. Backtesting function

- Historical since the beginning of 2014

- Rebalancing annually, quarterly or monthly

- Reconciliation of performance development of long, neutral and short portfolio

Family Officer / Client Relationship Manager

Your customers or yourself hold a stock portfolio that you want to analyze and monitor with the platform. For new ideas, call on LeanVal’s expertise. These functions of the platform are particularly interesting for you:

1. LeanVal sample strategies

- LeanVal Smart Beta Strategies

- Guru strategies

- Single-style strategies

2. Your individual strategies

- Analysis and valuation of selected equities

- Upload function of the own universe

The LeanVal equity screener

The LeanVal Screener is unique in its form and enables professional investors to use it in a variety of ways when selecting equities or managing a stock portfolio.

High data quality

The underlying figures are continuously evaluated by our analyzes with the help of artificial intelligence.

Historical back calculation

The backtest is calculated for six years with monthly, quarterly or annual rebalancing.

Scientific background

Strong focus on the conception of smart beta strategies or on long and short portfolios.

individuality

In addition to predefined strategies, any configuration of key figures can be tested.

High speed

Although several millions of data sets are processed, the calculation of the results only takes a few seconds.

In-depth analysis

We use different key figures for different industries so that you don't compare "apples with oranges".

sustainability

The results can be restricted to equities with high sustainability standards.

Easy handling

We are looking for a compromise between complex material and a simple user interface.

No investment advice

Our asset management is at your disposal for advice or implementation options for the screening results.