Monthly Update LeanVal Indices, Index Strategies and Conviction Portfolios

We have summarized the development and composition of our indices, index strategies and conviction portfolios in a compact report. This publication is an excerpt of our strategies, it serves as proof of our expertise and as a source of ideas for optimizing your equity strategy.

Short and long-term prospects for the development of the US dollar

With the monthly publication “Dr. Michael Heise on Global Economics”, we address current developments that have a significant impact on the economy and the capital markets.

In this issue, Dr. Michael Heise looks at the future development of the US dollar. He outlines the short and long-term prospects and discusses the future role of the dollar as a global reserve currency.

LeanVal Research Platform

Share valuation, share selection, share strategies. Use our platform in the current turbulent stock market phase.

Valuation of Banks - The Income Approach

The Academic Paper “Valuation of Banks – The Income Approach” by LeanVal Research deals with the special features of accounting for banks and presents some models for the valuation of financial institutions.

LeanVal Research GmbH

We stand for in-depth, independent, fundamental analysis and make investments smarter, more individual and more sustainable.

Welcome to LeanVal Research GmbH – your partner for digital, fundamental-analytical equity research at institutional level. We combine classic analysis quality with modern AI technology to offer professional investors a fully scalable and efficient solution: data-based, investable, communicable. Whether banks, asset managers or family offices – we deliver analyses, strategies and tools that really help you and your clients.

Welcome to LeanVal Research GmbH – your partner for digital, fundamental-analytical equity research at institutional level. We combine classic analysis quality with modern AI technology to offer professional investors a fully scalable and efficient solution: data-based, investable, communicable. Whether banks, asset managers or family offices – we deliver analyses, strategies and tools that really help you and your clients.

What drives us?

These are the answers to three central questions:

1. Which shares should you currently buy?

2. How can the historical development of a share be explained?

3. How does this information reach your employees and customers?

Stock analysis

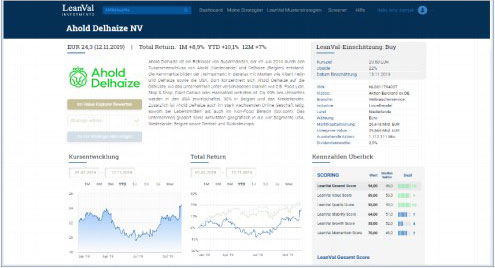

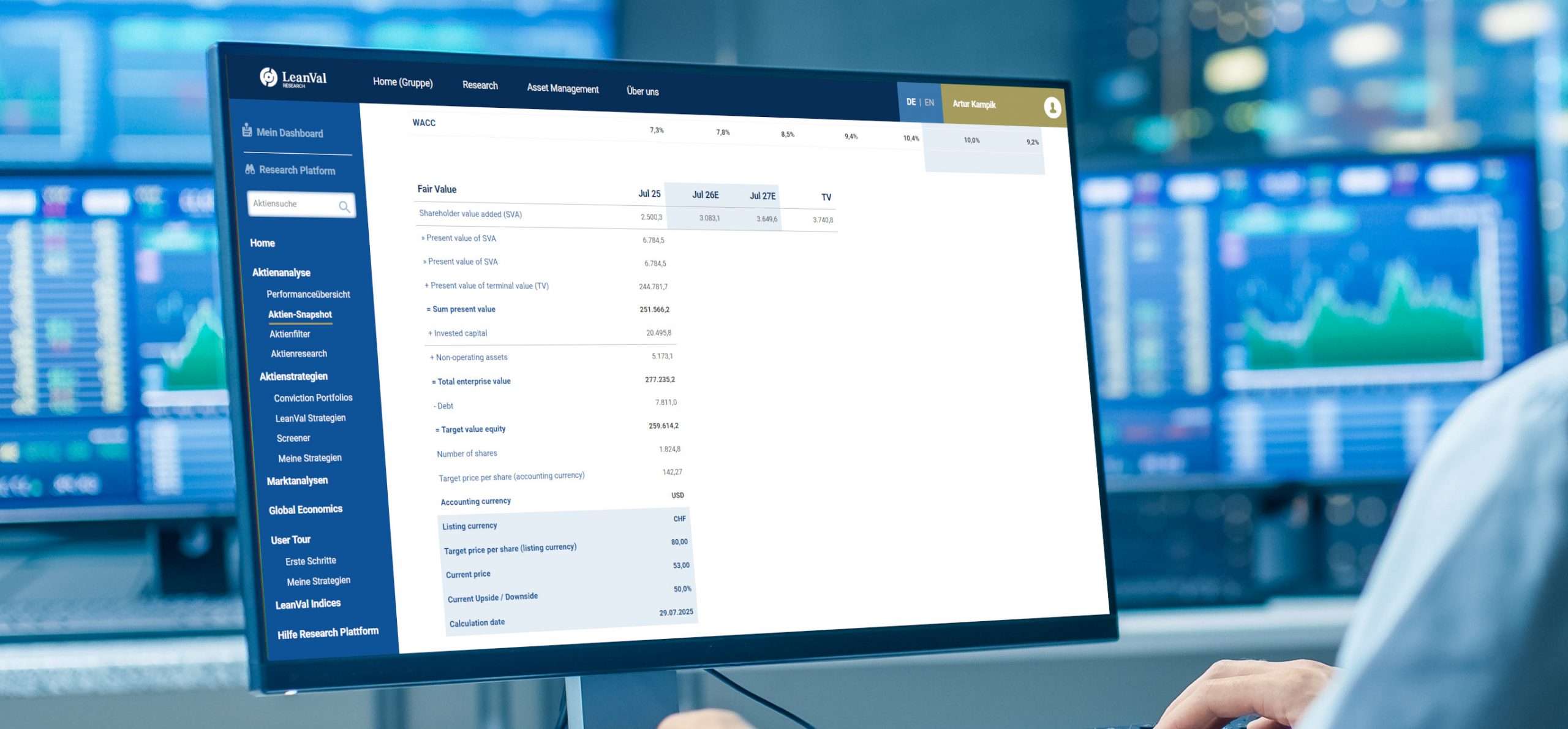

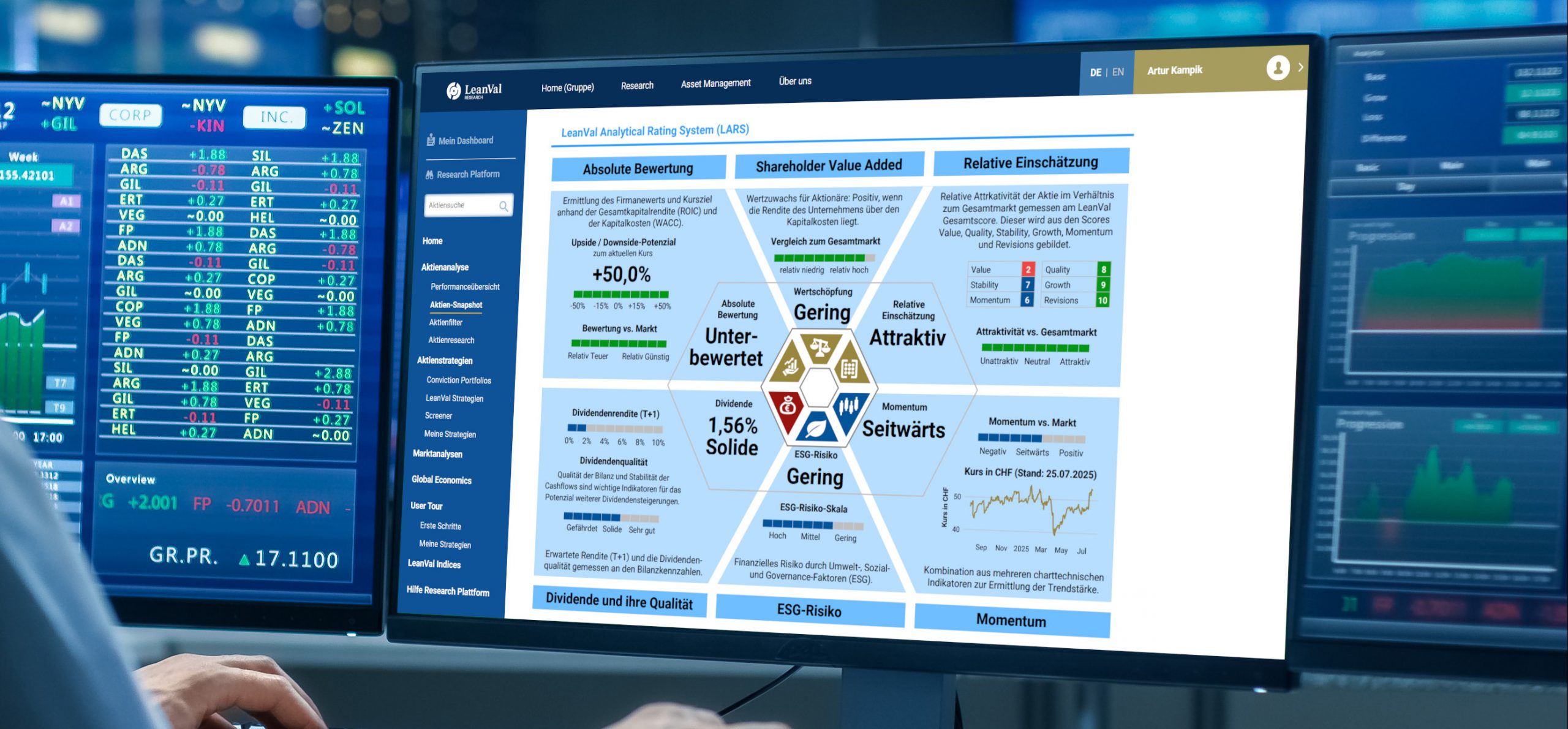

The research platform offers fundamental equity analysis with relative assessment and absolute valuation for approx. 600 European and approx. 500 US equities. Our goal is an above-average high quality of the data, both for historical and forecast annual financial statements. With the data, selection strategies for stocks can be designed quickly and easily and historically tested. In addition, LeanVal creates its own equity strategies. Visualized in the LeanVal Analytical Rating System (LARS) and available as an API, platform or individually designed factsheet. Ideal for B2B and B2B4C applications: from portfolio monitoring to end customer consulting.

Valuation models

Receive verified fundamental data, fair values and clear votes (buy/hold/sell) for over 1,200 European and US stocks. Transparent, comparable and ready to use – as an API, platform access or white label factsheet.

LeanVal Analytic Ratig System (LARS)

With LARS, you can recognize the key value drivers of a share at a glance. Complex key financial figures are translated into intuitive scores and visualizations – for faster analyses and better decisions.

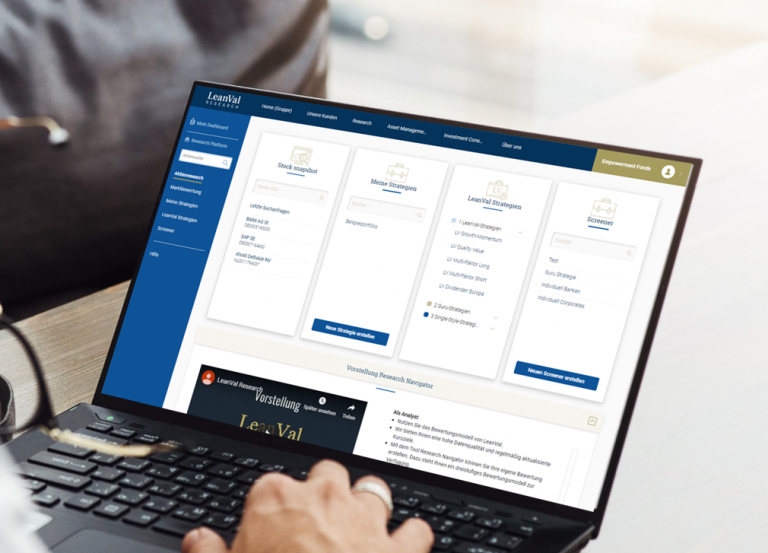

Equity strategies

Whether custom indexing, factor strategies or focused conviction portfolios – LeanVal develops investable strategies based on realistic backtests, regulatory compliance and automated implementation. With us, you don’t just get a research product, but a complete solution – including platform access, monitoring and communication packages in white-label format.

Indices and index strategies

Design your own index strategy – rule-based, transparent and with realistic backtests based on historical estimates. Choose from LeanVal, Factor or Guru strategies or develop your own individual set of rules.

Conviction Portfolios

Concentrate on the essentials: around 20 stocks with particularly attractive valuations, continuously monitored and actively adjusted. Ideal for banks and asset managers who want to offer their clients focused investment ideas.

LeanVal Research Platform

The research platform offers fundamental equity analysis with relative assessment and absolute valuation for approx. 600 European and approx. 500 US equities. Our goal is an above-average high quality of the data, both for historical and forecast annual financial statements. With the data, selection strategies for stocks can be designed quickly and easily and historically tested. In addition, LeanVal creates its own equity strategies.

Individual securities segment

In addition to an overview of the most important stock indices, the equity analyses include the equity snapshot with the ValueXplorer, the equity filter and research reports on individual stocks.

Portfolios area

Here you will find our active equity strategies and a range of themed stocks. You can create your stock lists or use the screener to create and test your own strategies.

Market analysis area

The ROIC approach uses a bottom-up process to draw conclusions about the attractiveness of individual countries and industries. Here they also receive analyses on specific megatrends.

Economics division

With the publication series “Dr. Michael Heise on Global Economics” we address current developments that have a significant impact on the economy and capital markets.

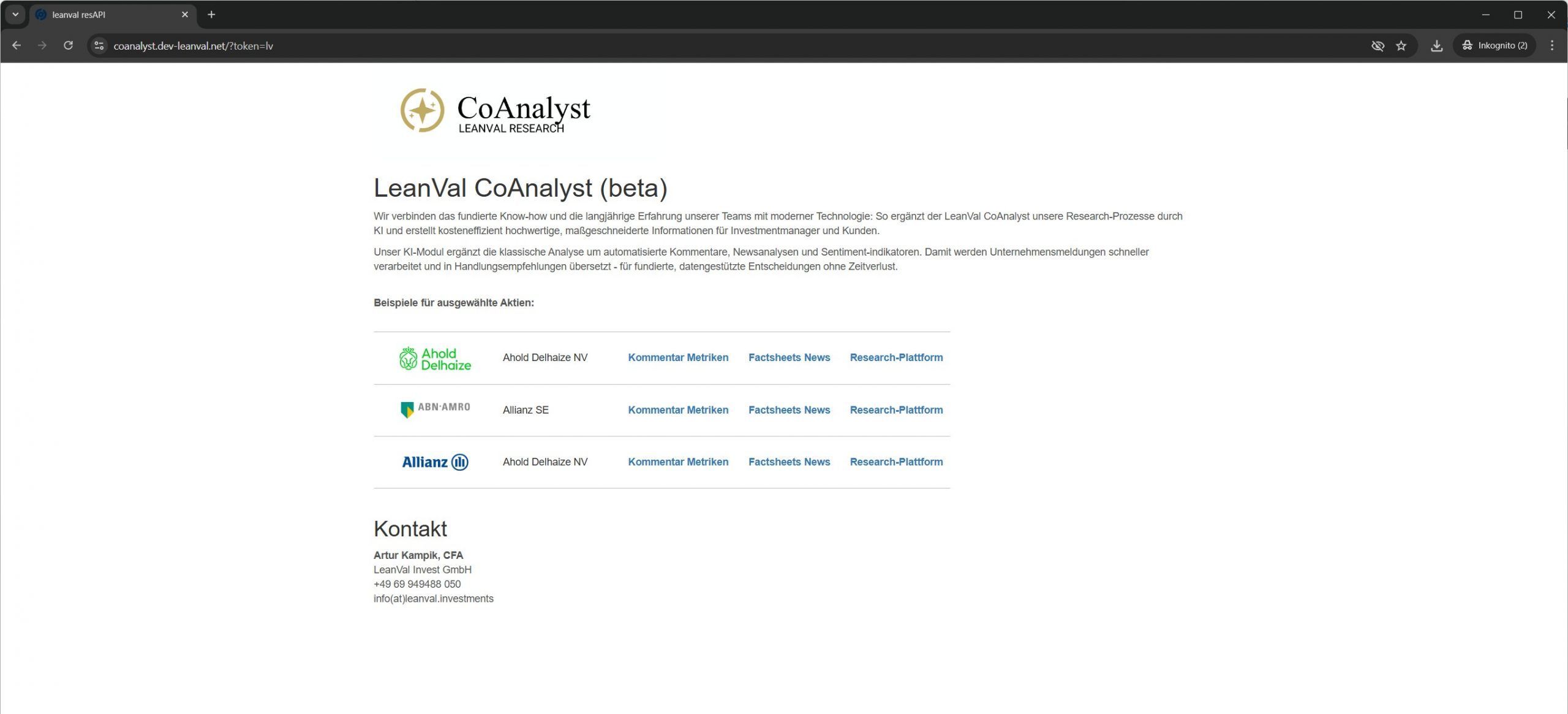

AI support with LeanVal CoAnalyst

The LeanVal CoAnalyst is our AI-supported answer to the challenges of modern analysis processes. It interprets evaluation models, analyzes company news and creates automated comments and sentiment indicators. For more speed, consistency and quality – and for communication that resonates with your customers.

Use of AI at LeanVal

The AI-supported companion for your investment analysis: interprets valuation models, analyzes company news and creates automated commentaries.

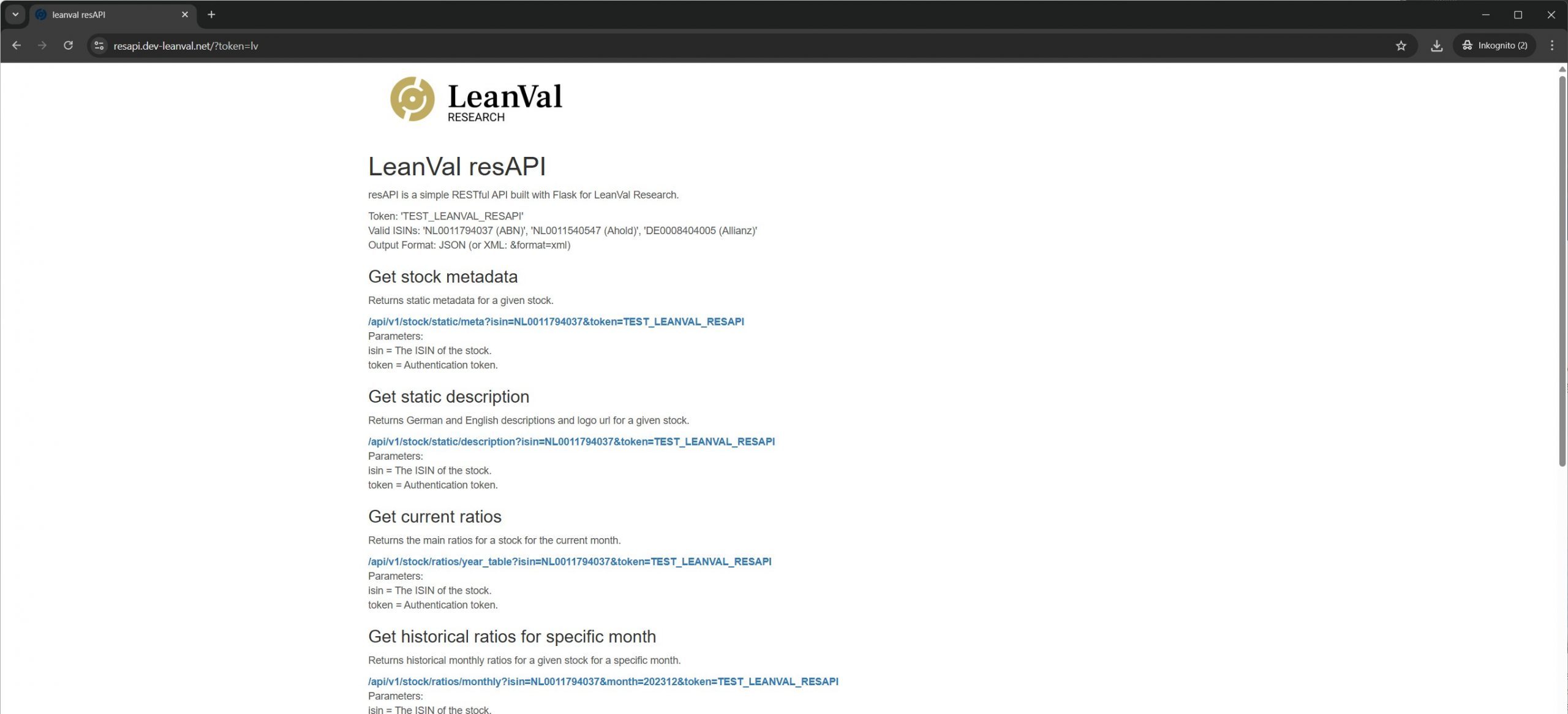

CoAnalyst API

Seamless integration into your systems: Access AI-generated analyses, comments and sentiment indicators directly – flexibly via our API.

Secondary Data Provider / API

As a secondary data provider, LeanVal delivers verified financial and valuation data combined with AI-generated content – ideal for robo-advisors, reporting platforms or banking IT. Flexible integration via API, Excel, JSON or directly via our platform. Our data is more than just numbers – it is ready-to-use information modules for your applications.

Our data

Use verified financial and valuation data combined with AI-generated content – ideal for banks, asset managers and platform providers.

Research API

Integrate LeanVal data directly into your systems: Fundamental data, fair values, ESG scores and automated comments – flexibly available via API.

Our services for investment managers, family offices, savings banks, banks and your end clients

For investment managers / family offices

We are the extended workbench of your investment office – and ensure maximum efficiency in strategy, implementation and monitoring.

Determination of the investment strategy: Individual equity strategies with backtesting, screener selection and weighting rules.

Rebalancing & monitoring: Weekly monitoring of fundamental risk parameters, rebalancing proposals and annotated “rebalancing factsheets”.

Portfolio management support: standardized data, votes, price targets, scores and daily factsheets for your entire universe.

LeanVal Platform & Data Services: Efficient integration of our data via platform, API or standardized formats (Excel, CSV, JSON).

For your end customers

Your customers benefit from a first-class service experience that impresses with consistent quality and professional support.

Conviction Portfolios for Advisory: Plug-and-play service – from strategy and monitoring to communication packages.

Individual share information: Price targets, votes, ESG data, absolute and relative valuations, news & commentary.

MiFID-compliant factsheets: Modular design, flexible to use, also as a white label solution with your branding.

Data integration for platforms & reporting: Seamless integration into your systems – via platform access, API or database.

Implementation in asset management

The LeanVal Group combines expertise and innovation: Our specialized subsidiaries, LeanVal Research and LeanVal Asset Management, complement each other to create unique, innovative solutions tailored to the needs of banks and savings banks, institutional investors, asset managers and family offices.

Core competencies

LeanVal Asset Management AG (LVAM)

LeanVal Research is not only a data provider, but also a strategic partner. Through service level agreements, our analyses flow directly into the products of LeanVal Asset Management AG – from equity strategies with hedging to overlay solutions with volatility components. This creates a unique combination of research expertise and asset management practice. For further information, see the company website:

Direct line to us:

14-day trial access:

Get free access to our latest analyst reports for a period of 14 days by completing our free trial.

Free access to our research reports

- Quant Select Fact Sheets

- Stocks in focus

- Stock Market Briefing

- Monthly and Quarterly Reports