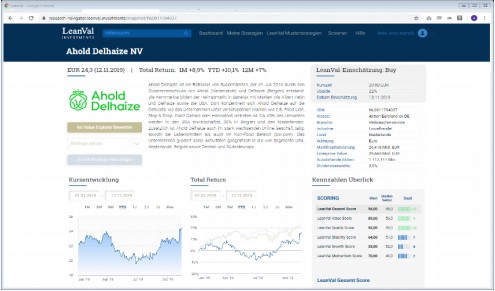

LeanVal Research Plattform

Stock valuation, stock selection, stock strategies. Use our platform in the current turbulent stock market phase.

Were the Russia sanctions a mistake?

With the monthly publication „Dr. Michael Heise on Global Economics“ we pick up on current developments that have a significant impact on the economy and capital markets.

The current issue notes that the results of the Russia sanctions are sobering at first glance. There is not even a rudimentary sign of a concession in the war against Ukraine. The energy price shock, on the other hand, has hit the economies in Europe hard. Were the sanctions a mistake?

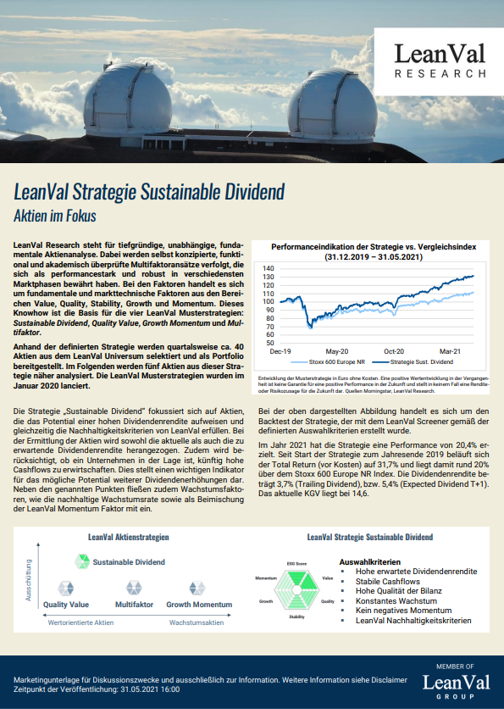

Shares in Focus "Sustainable Dividend"

The „Sustainable Dividend“ strategy focuses on shares with the highest dividend yield. It also takes into account whether a company is able to generate high free cash flows and whether this will continue to be the case in the future. This is an important indicator of the potential for further dividend increases.

Shares in Focus "Multifactor"

The LeanVal multifactor strategy uses the five factors Value, Quality, Stability, Growth and Momentum with equal weighting for stock selection. This makes the result robust to outliers, as focusing on one factor alone is unlikely to outperform the market over a longer period of time.

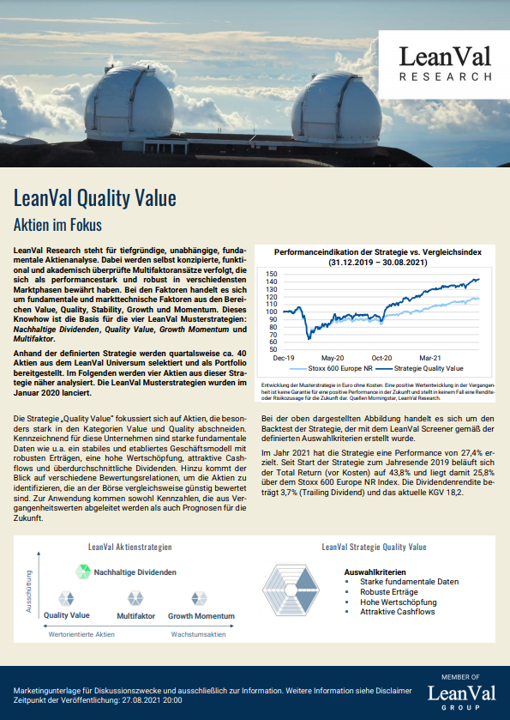

Shares in focus "Quality Value"

This strategy focuses on stocks that perform particularly well in the Value and Quality categories. These companies are characterized by strong fundamentals, a stable and established business model, and a comparatively favorable valuation on the stock market.

Valuation of Banks - The Income Approach

The Academic Paper „Valuation of Banks – The Income Approach“ by LeanVal Research addresses the specifics of bank accounting and presents some models for the valuation of financial institutions.